Market Overview

Drilling consumables manufactured and supplied by Robit are used for the needs of the mining, quarrying and forepoling,

underground construction and well drilling industries.

In 2023, market demand weakened in the construction industry. Market demand in the mining industry remained at a good

level, but several customers and distributors de-stocked during the year, also reducing Robit’s demand in the mining sector.

The company ceased operations in Russia at the end of 2022, which caused 8.3 percentage decrease in the company’s sales

in 2023.

Robit’s present market share, competitive products, extensive geographical coverage, and the steady demand typical of

consumables ensure good opportunities for Robit to grow by gaining market share from other operators in the industry. In

addition, the company expects the overall market for drilling consumables to grow beyond economic cycles by approximately

3 percent to 5 percent per year.

AMERICAS

Net sales in the Americas fell in 2023, especially in the mining industry. The company’s sales in the mining sector were weakened by the interruption of certain customers’ operations due to, among other things, a strike, and the termination of a customer contract with a significant turnover but low profitability. During the year, the company made investments to strengthen Geotechnical sales in the region, as a result of which the sales of the Geotechnical business developed positively in North America.

During the year, Robit started cooperation with several new distributors operating in large markets, such as Brazil, the mining sector in Canada and the mining and construction sector in the US. The reinforced distribution channels and coverage strengthen the company’s position in the region and provide a basis for growth.

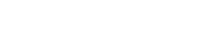

EMEA

EMEA sales operations are divided into four main regions: the Nordic countries, Central Europe, Middle East, and Africa.

In 2023, demand in the construction industry weakened, especially in the Nordic countries and Central Europe, which are important construction industry markets for Robit. Despite the weak market situation, the company was able to maintain the sales of the construction industry at the 2022 level.

In the mining industry, the company won new customers, especially in the Nordic countries and Africa. In South Africa, the company carried out a major rebuilding of its organisation. This slowed sales in the first half of the year but strengthened the company’s ability to grow in the region in the future. In the second half of the year, the company’s sales in southern Africa developed positively. The Middle East is a strongly developing region where, for example, infrastructure projects in Saudi Arabia support demand.

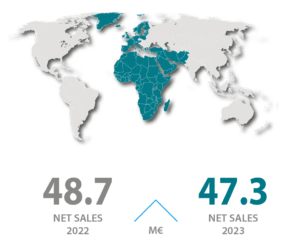

EAST

Sales in the East region decreased significantly from 2022 due to the closure of the Russian business. The company’s focus in the region is to increase sales, especially in the mining segment. No significant results were achieved in the region during 2023. Large customers in the region typically follow a very systematic supplier approval process that enables them to participate in competitive tendering. During 2023, the company worked hard to make the list of approved suppliers, which will enable growth in the region in the future.

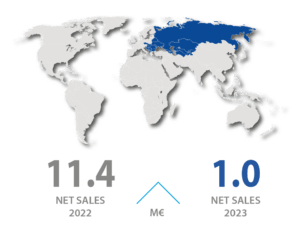

ASIA

In Asia, Robit focuses on the construction industry, especially tunnelling and mining. The construction industry’s relative share of net sales is higher in Asia than in the company’s other markets. The weakened demand in the construction industry contributed to a decline in net sales in Asia.

The company’s sales strengthened in Robit’s important Korean market, but sales in the rest of Asia decreased due to the market situation as well as the distributors’ high stock levels and de-stocking

during the year

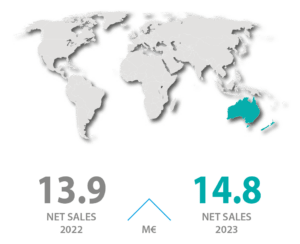

AUSTRALASIA

Robit’s business in the Australasia region is mainly focused on mining. The demand in the market was good, although a slight decrease was seen in prospection drilling toward the end of the year.

Sales in the region developed positively during the year due to new customers won – mainly underground mines that use Top Hammer drilling equipment. The company has several potential sales opportunities in the region, especially for underground mines, thanks to which the outlook for sales development in the region is positive.